Core concept

UNISOL Holdings Corporation views corporate governance as fundamentally about fulfilling our responsibilities to all stakeholders and future society. To that end, we aim for cohesive Group management through agile and efficient decision-making under a fair and transparent management system, ultimately striving for sustainable growth and enhanced medium- to long-term corporate value.

Our Board of Directors is responsible for charting the strategic direction of the Group, efficiently securing and appropriately allocating Group management resources, formulating and executing capital policies, and overseeing the construction and operation of internal control systems throughout the entire Group. This allows us to accurately identify business risks within the Group and thoroughly manage overall profit and risk—contributing to the establishment of a robust Group management system.

Furthermore, we have established the Group Philosophy (our slogan, vision, mission, 3 values, and 7 standards) as the fundamental management principles shared by all employees of the Group. We will continuously work to strengthen corporate governance through the practical application of these principles.

Related links

Corporate governance structure

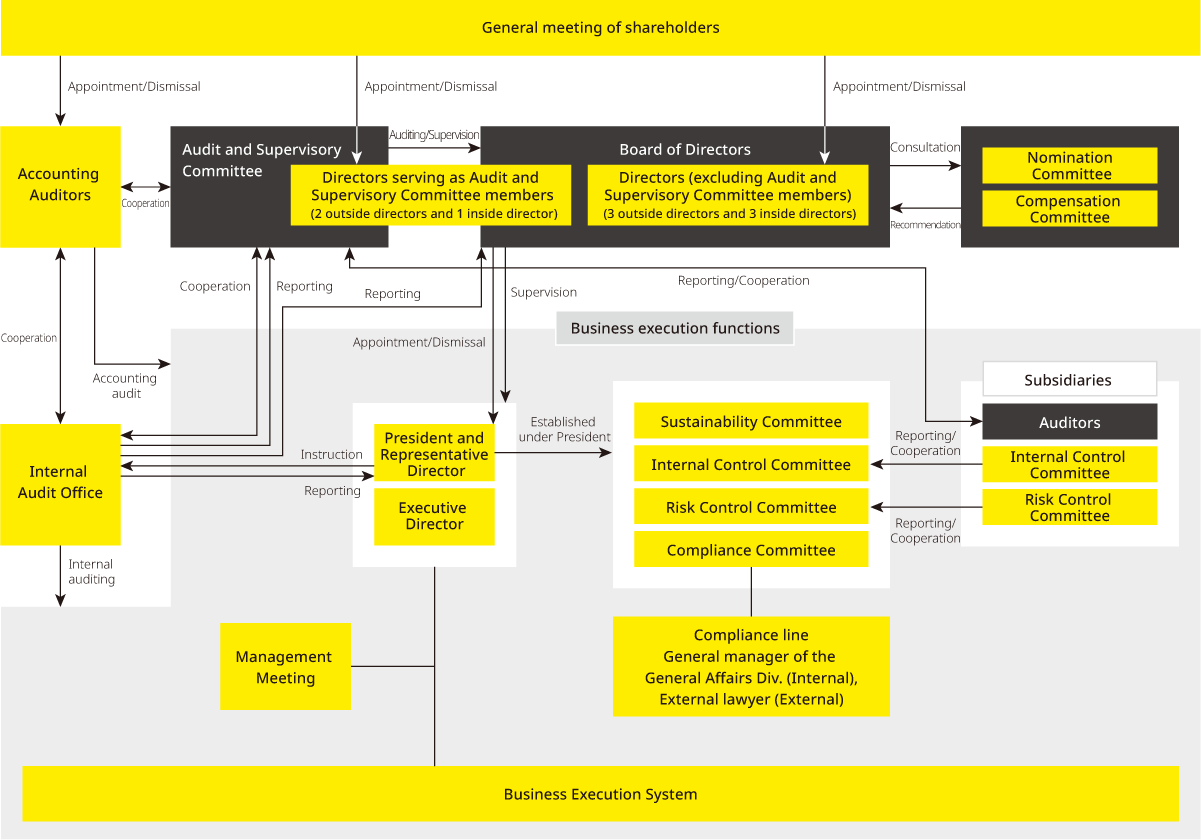

UNISOL Holdings Corporation is structured as a company with an Audit and Supervisory Committee. We have established a Board of Directors, an Audit and Supervisory Committee, and appointed an Accounting Auditor. Furthermore, we maintain an Internal Audit Office which, in collaboration with the Audit and Supervisory Committee, strengthens our monitoring functions across all daily operations.

As a corporate oversight function, we have a system comprised of one full-time Director and two Outside Directors serving as Audit and Supervisory Committee members to audit the execution of duties by Directors. Of these, the two Outside Directors on the Audit and Supervisory Committee have been appointed as independent directors, allowing them to attend Board of Directors meetings and other important bodies from a position distanced from management, thereby enhancing the effectiveness of corporate oversight.

At UNISOL Holdings Corporation, we have established a governance system where Outside Directors monitor the execution of duties by each Director independently and fairly, which is why we are maintaining our current structure.

Diverse officer skills

UNISOL Holdings Corporation’s officers possess knowledge and experience suited to the UNISOL Group’s wide-ranging business domains. When appointing officers, we comprehensively review candidates with reference to the range of skills possessed by our cohort of officers and the Company’s management strategy, with consideration for creating an optimal balance between execution and oversight of business.

Recognizing our fiduciary duty to shareholders, we have established “Policies and Procedures for the Appointment and Dismissal of Directors” to ensure that the Board of Directors appropriately fulfills its roles and responsibilities when appointing and dismissing both director candidates who are not Audit and Supervisory Committee members and those who are.

Our outside officers meet the independence requirements stipulated by the Companies Act and the financial instruments exchange on which we are listed, as well as our own independence criteria.

Related links

Board of Directors

Composition of our Board of Directors

We transitioned from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee, following approval of amendments to the Articles of Incorporation at the Fourth Annual General Meeting of Shareholders held on March 28, 2025. As of March 28, 2025, our Board of Directors consists of nine members: six Directors (excluding those also serving as Audit and Supervisory Committee members, and including three Outside Directors), and three Directors also serving as Audit and Supervisory Committee members (including two Outside Directors).

Subjects debated and matters reported

The chief subjects debated by and matters reported to the Board of Directors in the fiscal year ended December 31, 2024 are outlined below.

| Subjects debated and matters reported | No. of issues |

|---|---|

| Management strategies | 20 |

| Financial results and other financial matters | 15 |

| Sustainability, governance, internal control, risk management, and compliance | 13 |

| Matters relating to the Board of Directors, Nomination Committee, Compensation Committee, and human resources | 11 |

| Matters relating to Audit & Supervisory Board Members, internal audit divisions, and Accounting Auditors | 4 |

| Discrete cases | 15 |

Attendance

The attendance record of each Director at Board of Directors meetings for the fiscal year ended December 31, 2024 is as follows. (As of December 31, 2024)

| Position | Name | Attendance |

|---|---|---|

| Chairperson and Representative Director | Kunihiko Iida | 100% (13 of 13 meetings) |

| President and Representative Director | Ryohei Furusato | 100% (13 of 13 meetings) |

| Director and Senior Managing Executive Officer | Toshiaki Takeshita (Note 1) | 100% (3 of 3 meetings) |

| Director and Senior Managing Executive Officer | Katsuhiro Yamashita | 100% (13 of 13 meetings) |

| Outside Director | Kazuaki Kotani (Note 1) | 100% (3 of 3 meetings) |

| Outside Director | Hiroyuki Nakatsukasa | 100% (13 of 13 meetings) |

| Outside Director | Junko Takechi | 100% (13 of 13 meetings) |

| Outside Director | Hisao Takahashi (Note 2) | 100% (10 of 10 meetings) |

Notes: 1. Toshiaki Takeshita and Kazuaki Kotani resigned at the conclusion of the Third Annual General Meeting of Shareholders held on March 28, 2024; therefore, only Board of Directors meetings held before their resignation are included in the attendance record.

2. Hisao Takahashi assumed office on March 28, 2024, at the Third Annual General Meeting of Shareholders; therefore, only Board of Directors meetings held after his assumption of office are included in the attendance record.

Audit and Supervisory Committee

The Audit and Supervisory Committee is comprised of three Directors also serving as Audit and Supervisory Committee members (including two Outside Directors). These Directors possesses expertise in management, finance, and accounting to a considerable degree.

Nomination Committee and Compensation Committee

In the aim of increasing the impartiality and objectivity of operations relating to Director nomination, remuneration, and related issues, we have established a Nomination Committee and a Compensation Committee, both under the purview of the Board of Directors and comprising a majority of Outside Directors. Both function as advisory committees and are chaired by an Outside Director.

The Nomination Committee discusses, at the request of the Board of Directors, proposals for the General Meeting of Shareholders regarding the appointment and dismissal of Directors, while the Compensation Committee discusses matters concerning remuneration of individual directors, and reports on the details of these discussions to the Board of Directors.

Composition and attendance

The composition of the Nomination Committee and Compensation Committee and attendance of both Committees’ meetings in the fiscal year ended December 31, 2024 are outlined below.

Nomination Committee

| Name (position) | Attendance | |

|---|---|---|

| Chairperson (Up to March 28, 2024) | Kazuaki Kotani (Outside Director) (Note 1) | 1 of 1 meetings |

| Chairperson (From March 28, 2024) | Junko Takechi (Outside Director) (Note 2) | 2 of 2 meetings |

| Members | Kunihiko Iida (Chairperson and Representative Director) | 2 of 2 meetings |

| Members | Ryohei Furusato (President and Representative Director) | 2 of 2 meetings |

| Members | Hiroyuki Nakatsukasa (Outside Director) | 2 of 2 meetings |

| Members | Hisao Takahashi (Outside Director) (Note 3) | 1 of 1 meetings |

Notes: 1. Mr. Kazuaki Kotani retired from office at the conclusion of the Third Annual General Meeting of Shareholders held March 28, 2024; his attendance record therefore considers only Nomination Committee meetings held prior to his retirement.

2. Ms. Junko Takechi was appointed to the position of Chairperson at the Third Annual General Meeting of Shareholders held March 28, 2024. Her attendance record also includes meetings of the Nomination Committee that she was eligible to attend in her previous capacity as its member, prior to her appointment as its Chairperson.

3. Mr. Hisao Takahashi assumed office on the day of the Third Annual General Meeting of Shareholders held March 28, 2024; his attendance record therefore considers only Nomination Committee meetings held after his assumption of office.

Compensation Committee

| Name (position) | Attendance | |

|---|---|---|

| Chairperson | Hiroyuki Nakatsukasa (Outside Director) | 3 of 3 meetings |

| Members | Kunihiko Iida (Chairperson and Representative Director) | 2/3 meetings |

| Members | Ryohei Furusato (President and Representative Director) | 2/3 meetings |

| Members | Junko Takechi (Outside Director) | 3 of 3 meetings |

| Members | Kazuaki Kotani (Outside Director) (Note 1) | 1 of 1 meetings |

| Members | Hisao Takahashi (Outside Director) (Note 2) | 2 of 2 meetings |

Notes: 1. Mr. Kazuaki Kotani retired from office at the conclusion of the Third Annual General Meeting of Shareholders held March 28, 2024; his attendance record therefore considers only Compensation Committee meetings held prior to his retirement.

2. Mr. Hisao Takahashi assumed office on the day of the Third Annual General Meeting of Shareholders held March 28, 2024; his attendance record therefore considers only Compensation Committee meetings held after his assumption of office.

The composition of the Nomination Committee and Compensation Committee as of March 28, 2025 is outlined below.

| Nomination Committee | Compensation Committee | |

|---|---|---|

| Chairperson | Junko Takechi (Outside Director) | Hiroyuki Nakatsukasa (Outside Director) |

| Members | Kunihiko Iida (Chairperson and Representative Director) | Kunihiko Iida (Chairperson and Representative Director) |

| Members | Ryohei Furusato (President and Representative Director) | Ryohei Furusato (President and Representative Director) |

| Members | Hiroyuki Nakatsukasa (Outside Director) | Junko Takechi (Outside Director) |

| Members | Hisao Takahashi (Outside Director) | Hisao Takahashi (Outside Director) |

Assessment of the effectiveness of the Board of Directors

In order to verify whether the Board of Directors is functioning by fulfilling its role and responsibilities, and in the aim of improving that functioning, the Company conducts an assessment of the effectiveness of the Board of Directors as a whole each business year.

The assessment method for the fiscal year ended December 31, 2024 and an overview of the results are as follows.

Assessment method

Implementation period

December 2024

Assessment targets

Total of nine people: six Directors (including three Outside Directors) and three Audit and Supervisory Committee members (including two Outside Directors)

Implementation details

Self-assessment (the previous fiscal year, ended December 31, 2023, was assessed by a third-party organization)

The assessment method involves a questionnaire for all participants on the following items (each item rated on a 5-point scale, with accompanying comments from each individual), followed by analysis and evaluation by the Board of Directors.

Issues assessed by our questionnaire

- The nature and composition of the Board of Directors

- Operation of the Board of Directors

- Deliberations of the Board of Directors

- Monitoring functions carried out by the Board of Directors

- Dialogue with shareholders and investors

- Responsibilities of and support system for Directors and Audit & Supervisory Board Members

- Operation of the Nomination Committee and Compensation Committee

Overview of assessment results

The results of the Board of Directors’ assessment of its own effectiveness are summarized below.

- The assessment that the Board of Directors is comprised of diverse members remains consistent, and an environment conducive to free and open discussion has been maintained.

- Significant improvements were recognized in both the quality and quantity of materials provided for discussions at Board of Directors meetings.

- Regarding the points identified as priority themes following the results of the previous effectiveness assessment, progress and achievements have been made as follows:

・Strengthening monitoring functions

Through increased information provision and deepened discussion, monitoring of management is functioning effectively. The company decided and implemented a change to its organizational structure – transitioning from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee – in order to further enhance these functions.

・Further revitalization of the Nomination Committee

Progress in discussions regarding director candidate selection policies, and concrete discussion of succession planning for Board of Directors members.

・Enrichment of discussions to enhance corporate value

Increased and progressing discussions on business portfolios and sustainability. - However, it was indicated that further discussion is needed on themes such as business strategy and capital strategy. Strengthening post-implementation follow-up on matters discussed (and decided) by the Board of Directors remains an ongoing challenge.

- Strengthening the structure as a company with an Audit and Supervisory Committee, monitoring Group-wide business restructuring, and addressing new challenges are also essential.

Future initiatives

Based on the assessment results, we confirmed that the effectiveness of the Company’s Board of Directors is generally ensured. While we also confirmed a certain degree of success and progress, as discussed above, in the three areas identified as priority themes for initiatives following the results of our previous assessment, we also received valuable opinions and suggestions from the viewpoint of further improvement of effectiveness. Based on these findings, the Board of Directors will continue to focus on these three items as priority themes and will continue to discuss and address them in conjunction with medium- to long-term strategies and organizational strengthening.

- Enhancement of monitoring functions

・Clarification and strengthening of the supervisory functions to be fulfilled by the Board of Directors as a company with an Audit and Supervisory Committee

・Continued enhancement of supervisory functions regarding business portfolio, sustainability initiatives, and risk management - Further invigoration of the Nomination Committee

・Intensification of succession planning for Board of Directors members, including the CEO

・Promotion of the development of appointment policies, criteria, and procedures for director candidates under the new organizational structure - Enhancement of discussions on improving corporate value

・Review of agenda setting criteria and, based on that review, improved discussion efficiency and accelerated decision-making

・Provision of time for discussing “strategic themes” not included in the agenda setting criteria