Policy on Returning Benefits to Shareholders

With the aim of realizing sustained growth in corporate value, we have identified three key areas that we need to focus on: strengthening our earning ability, reducing the cost of capital, and portfolio management. To realize these goals, we have chosen six key strategies; by implementing measures for each of these strategies, we are aiming to achieve a sustainable increase in corporate value, and seeking to consistently keep our price-to-book ratio (PBR) at over 1.0 (see “Regarding Measures for Realizing Cost-of-Capital- and Share Price-Conscious Management,” which was announced on March 28, 2024). As part of our financial capital strategy, one of the six key strategies referred to above, we are working to strengthen the returning of profit to shareholders. With regard to ordinary dividends, our dividend policy is to realize a continuing increase in dividends based on the dividend on equity (DOE) ratio. We will also be implementing additional measures to return profit to shareholders in a flexible manner in line with profit levels and the company’s financial status, such as special dividends and share buybacks.

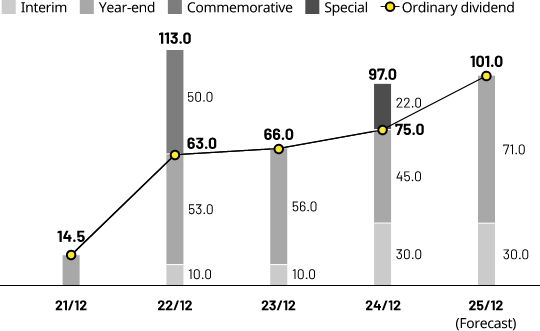

Dividend policy

- Maruka Furusato Corporation attaches great importance to providing shareholders with stable dividends over the long term, and strives to increase dividends through medium- and long-term earnings growth.

- With regard to ordinary dividends, our medium- and long-term target is to maintain a DOE ratio of at least 3.5%, with a basic policy of realizing a continuing increase in the amount of dividends issued.

- DOE ratio is set at 3.5% from the fiscal year ending December 31 2025.

- Besides ordinary dividends, we will also be implementing additional measures to return profit to shareholders in a flexible manner in line with profit levels and the company’s financial situation, such as the issuing of special dividends.

| Fiscal year | Dividend amount | ||

|---|---|---|---|

| Interim | Year-end | Total | |

| FY2025 (forecast) | 30.00 yen | 71.00 yen | 101.00 yen |

| FY2024 | 30.00 yen | 77.00 yen Of which, special dividends: 32.00 yen |

107.00 yen Of which, special dividends: 32.00 yen |

| FY2023 | 10.00 yen | 56.00 yen | 66.00yen |

| FY2022 | 10.00 yen | 103.00 yen Of which, commemorative dividends: 50.00 yen |

113.00 yen Of which, commemorative dividends: 50.00 yen |

Note: On April 15, 2024, we announced a “Notice Regarding Change in Shareholder Return Policy and Revision of Dividend Forecast” (for more details, click here)

Note: On April 23, 2024, we announced a “Notice Regarding Expected Recording of Extraordinary Income, Revision of Earnings Forecasts, and Revision of Dividend Forecast (Special Dividend)” based on the “Decision Regarding Reduction of Strategic Shareholdings” that was announced on March 28, 2024 (for more details, click here)

Note: On February 14, 2025, we announced that we had achieved our target of raising the DOE ratio to 3.5% ahead of schedule, and that in the next fiscal year (the fiscal year ending December 31, 2025) we would be taking a DOE ratio of 3.5% as the baseline for issuing dividends (for more details, click here)

Share buybacks

Maruka Furusato Corporation’s policy regarding returning profits to shareholders stresses the importance of implementing additional measures for returning value to shareholders in a flexible manner in line with profit levels and the company’s financial situation, such as the issuing of special dividends.

In line with the “Notice Regarding a Decision on Share Buybacks” that was announced on August 21, 2023, a decision was made on May 27, 2024 regarding the specific method to be used for implementing share buybacks, and at 08:45 a.m. on May 28, 2024 we gave instructions for the repurchase of a quantity of the company’s own shares using the Tokyo Stock Exchange’s ToSTNeT-3 system for off-floor own company share repurchase transactions.

| Period of repurchase | Quantity of shares repurchased | Total amount paid |

|---|---|---|

| Aug. 22, 2023 – May 28, 2024 | 1,512,200 shares | ¥3,615,451,800 |

Shareholder benefit program

For shareholders who hold 100 shares or more and who are recorded in the shareholder registry and the beneficial shareholder registry as of December 31 every year, the Company will send the following benefit once a year based on the following standard.

(1) Benefit items and standard

Benefit item: UNISOL-branded QUO Card

(image)

| No. of shares held as of the date of record | Held for less than three years | Held for a continuous period of at least three years |

|---|---|---|

| 100 shares or more but less than 200 | 500 yen | 1,000 yen |

| 200 shares or more but less than 500 | 1,000 yen | 3,000 yen |

| 500 shares or more | 5,000 yen | 10,000 yen |

(2) Timing of delivery

Scheduled to be delivered in March every year

Supplementary explanation regarding the long-term shareholder benefits system

We define “holding shares in the company for three years or more” as having the same shareholder number entered or recorded in the company’s shareholder registry on June 30, and on December 31, each year for a total of at least seven consecutive instances. For the initial determination of the long-term shareholding period, we perform this calculation back to December 31, 2021. For those shareholders listed in the shareholder registry as holding at least 1 unit (100 shares) of the company’s stock as of December 31, 2024, we check the shareholder status for the previous six instances, going back to December 31, 2021, to determine the period of continuous shareholding. Going forward, the calculation will continue to be performed for the previous three years as of that time.

(For the full text of the supplementary explanation (in Japanese), click here)